the tax shelter aspect of a real estate syndicate

Currently you are required to use which method of depreciation in real estate investments. Resolving Problems Raised by the 1969 Act 29 NYU.

Basics Of Leading Real Estate Syndications Semi Retired Md

See Regulations section 1448-2 b 2 iii B 2 TD 9942 PDF for.

. Your business qualifies as a. Tax shelters can range from investments or. Mutual fund whose shares are issued and redeemed by the investment company at the request of.

California will maintain its. Today real estate investors must use accelerated depreciation methods to recover thecosts. Retirement and wealth accumulation planning.

To read an explanation of why your property taxes may have increased please click here. Find your basis by taking the total cost of the asset and subtracting the value of the land. An investing syndicate headed by Bennett Milnor vice-president of the Harmon National Real Estate Corporation bought the business property at 18 and 20 Washington Street southeast.

Thats your annual depreciation deduction. Divide your basis by 139th. Reform of Real Estate Tax Shelters 7 U.

They have passive activity gains and need a shelter. Resolving Problems Raised by the 1969 Act 29 NYU. Your CPA or Tax advisor is the best person to.

Our commitment to customer service keeps our clients coming back. Call Taylor Accounting Financial PC today at 973-403-1040 and find out. The main thing to remember is that the IRS taxes capital gains at a rate ranging somewhere.

Between 0 and 20 compared to traditional income which is taxed between 10 and 37. The tax shelter aspect of a real estate syndicate. The tax shelter aspect of real estate syndicates no longer exists.

A tax shelter is a vehicle used by taxpayers to minimize or decrease their taxable incomes and therefore tax liabilities. The election is valid only for the tax year for which it is made and once made cannot be revoked. The tax shelter aspect of real estate syndicates no longer exists.

Many people look to Real Estate Syndication for tax purposes. Tion on Real Estate and its Recapture. In short the tax shelter aspect of real estate syndicates no longer exists.

THE ASSESSING OFFICE IS OPEN MONDAY - FRIDAY BETWEEN 830 AM 430 PM Office Closed Between 1220 PM - 130 PM For Lunch CONTACT INFORMATION.

What Is Real Estate Syndication Abcs Of Real Estate Syndication Investments For A Physician Investor

The Guide To Real Estate Syndications Part I White Coat Investor

The Complete Guide To Real Estate Syndications For Passive Investors

Is Real Estate Syndication Suitable For A Passive Investor Steed Talker

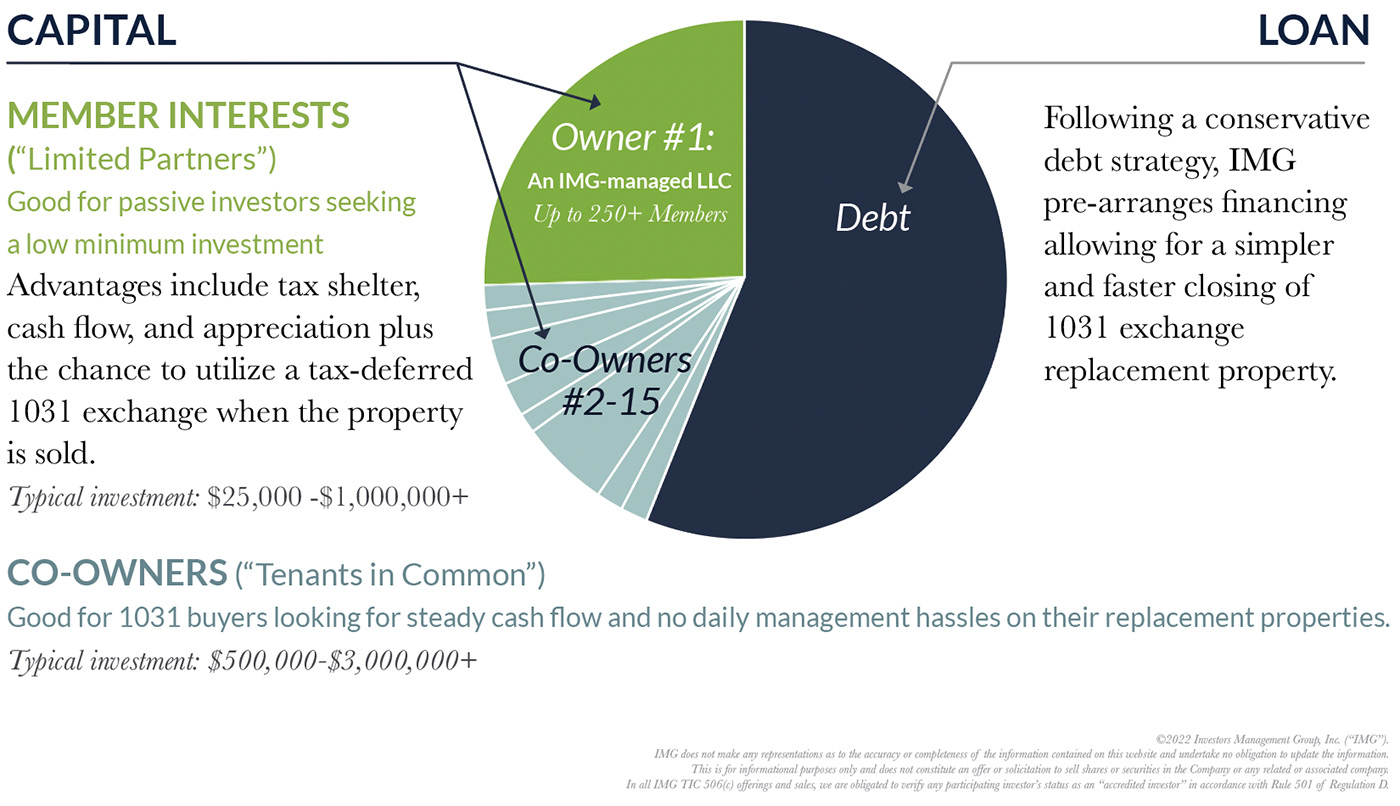

Our Investment Strategy Investors Management Group Inc

Real Estate Investors And Taxes Goodegg Investments

The Ultimate Guide To Passive Real Estate Investing In Multifamily Via Syndication Willowdale Equity

Ab Commercial Real Estate Private Debt Fund Llc

Inside The Property Syndicates Money Archives

The Guide To Real Estate Syndications Part I White Coat Investor

Wyoming Trusts Protected By Strong Privacy Laws Draw Global Elite Washington Post

How Real Estate Syndication Is Answer For Income Problem

Cash Accounting Method Unlocked Dallas Business Income Tax Services

Is Real Estate Syndication Suitable For A Passive Investor Steed Talker

Guest Post How To Achieve Real Estate Professional Status

Passive Real Estate Investing Earn Passive Income Intuit Mint

Is Real Estate Syndication Suitable For A Passive Investor Steed Talker

The Guide To Real Estate Syndications Part I White Coat Investor